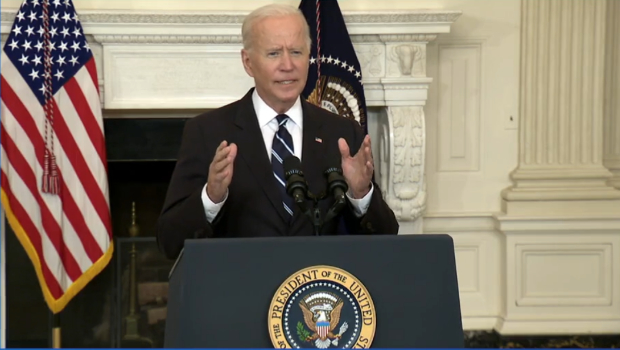

The federal student loan forgiveness announcement by President Biden spells relief for 43 million Americans, including many Connecticut teachers.

Individuals earning less than $125,000 and households earning less than $250,000 are eligible to receive up to $10,000 in federal loan debt cancellation. Qualified borrowers with Pell Grants, designed for low-income students, are eligible for up to $20,000 in forgiveness. Only currently outstanding debts are eligible for forgiveness.

In addition to debt cancellation, Biden’s announcement also extends the current pause on student loan repayment until Dec. 31, 2022, for all borrowers and will reduce future payments for many under income driven repayment plants. Currently those enrolled in such plans must pay 10% of their discretionary income toward their loans; the Biden announcement lowers that to 5% while raising the amount of income considered non-discretionary, protecting it from repayment.

Many teachers are also eligible for the Public Service Loan Forgiveness program. The previously onerous and confusing program underwent changes last year. Those seeking to apply for public service loan forgiveness under the current rules must do so by Oct. 31.

Alliance District teachers in Connecticut with private loans have access to a new state program that can save them up to thousands of dollars over the life of their loan by allowing a refinance of existing private student loan debt. Find out more.

For assistance with either student loans or credit card debt, check out Cambridge Credit Counseling, a CEA member benefit.