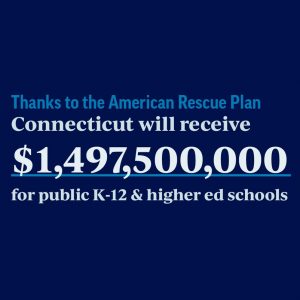

The American Rescue Plan that passed the U.S. House of Representatives on Wednesday and President Biden today signed into law includes more than $120 billion in aid for K-12 schools and will cut in half the number of children living below the poverty line.

“The hardships created by this pandemic aren’t over, but today is nevertheless a great day for America’s children,” said CEA President Jeff Leake. “Teachers are very thankful that President Biden and Congress have listened to educators and aim to address not only the learning loss children have experienced during this pandemic but also the trauma so many have faced and continue to face.”

Connecticut K-12 schools will receive more than $1.1 billion, funding that will largely be allocated to districts in proportion to the amount of Title I funding they receive. Approximately 25 percent of the funding heading to states and districts must be set aside for summer school, summer enrichment, and extended-day programs to help with learning recovery.

Outside of that 25 percent, funds are to be focused particularly on the needs of low-income students, children with disabilities, English learners, and children who are members of racial and ethnic minorities. Funding can be used for a wide variety of measures including providing mental health services and supports, purchasing educational technology, and facility repairs and improvements to reduce the risk of virus transmission (such as repairs to HVAC systems).

“The impacts of the American Rescue Plan will be felt immediately,” said Congresswoman Jahana Hayes. Provisions from Hayes’ Save Education Jobs Act included in the plan will protect funding for low-income school districts and ensure education funding is spent responsibility.

“There’s pretty substantial flexibility to states for how to use this money,” said Senator Chris Murphy. “A small percent must be used for summer programming, for camps—not just school. A small percent must be spent on students with IEPs, but broadly, schools will be able to fit these dollars to their needs.”

“The funding Connecticut schools receive must be used to support our must vulnerable students and keep our schools safe,” said Leake. “These additional dollars provide us with an opportunity to address inequities that have systemically impacted students and communities of color, hire more educators—including counselors to support students’ mental health needs, improve air quality in our schools, and take other measures to keep students and teachers healthy and safe. We know this is just the beginning of what we need to do to build back better.”

“The funding Connecticut schools receive must be used to support our must vulnerable students and keep our schools safe,” said Leake. “These additional dollars provide us with an opportunity to address inequities that have systemically impacted students and communities of color, hire more educators—including counselors to support students’ mental health needs, improve air quality in our schools, and take other measures to keep students and teachers healthy and safe. We know this is just the beginning of what we need to do to build back better.”

The bill requires schools to be transparent about reopening plans and provides $800 million dedicated to wraparound services for students experiencing homelessness.

“The good news is that the education dollars can be spent over a number of school years,” said Murphy. “And so, there are some cases in which the education dollars can be spent into the 2024 school year and beyond. We recognize that you can’t make up for learning loss in a year, you can’t deal with the emotional trauma of not being able to be with your peers or being at home in an unsafe environment in a year.”

Senator Murphy spearheaded the effort to ensure funding for summer programs could be allocated to recreation and enrichment and not merely academic remediation.

“I look at this summer as a tremendous opportunity,” Murphy said. “My fear is that if you give all the money to the school systems without any dedicated money for summer programming, all that will happen is that kids will be put in summer school. And that’s not what every kid needs. In fact, I would argue that’s not what most kids need this summer. Most kids need social reengagement this summer, and that doesn’t always come through summer school programming.”

Other measures in the bill include $7 billion for internet connectivity and devices and $39 billion for early-childhood programs.

Reducing childhood poverty

In addition to $1,400 direct payments to most Americans, the bill also provides families with a child tax credit sought for nearly twenty years by Congresswoman Rosa DeLauro. Individuals earning $75,000 or less and married couples earning up to $150,000 will receive $3,600 for children under age 6 and $3,000 for children ages 6-17, with the credit phased out completely for individuals earning $95,000 and above and joint filers making above $170,000.

“The moment has found us,” said DeLauro. “The crystallization of the child tax credit and what it can do to lift children and families out of poverty is extraordinary. We’ve been talking about this for years.”

Unlike the existing program that offers families the tax credit annually when they file their taxes, the relief package will provide families with monthly payments expected to start this summer, providing a stable cash flow.

The credit is also being extended to millions of families who earn too little to qualify for the credit under existing law. The Center on Poverty and Social Policy at Columbia University estimates that the credit will reduce child poverty by 45 percent overall and 52 percent for African Americans.

Though the bill only implements the tax credit for this year, Senator Murphy said he thinks when Congress sees the benefit and hears the clamors from Americans to make the credit permanent that it will answer that call.

“I think we are going to see the immediate benefits of lifting half the kids who are currently living in poverty out of poverty,” he said. “I think we’re going to see that in educational achievement, I think we’re going to see it in the benefit that accrues to their health.”

“We applaud the leadership of President Biden and Vice President Harris, Speaker Pelosi and Leader Schumer and the representatives and senators for getting the job done,” said NEA President Becky Pringle. “We have an unprecedented opportunity to create the public schools all students—Black and white, Native and newcomer, Hispanic and Asian alike—need and deserve. Our work is not over.”