More than 2.5 million people dedicated to public service, including Connecticut teachers, have their Social Security benefits reduced—or lose them entirely—due to the federal Windfall Elimination Provision (WEP) and Government Pension Offset (GPO).

As teacher shortages worsen across the nation, it’s more important than ever to urge Congress to repeal these penalties to better attract and retain educators.

The WEP reduces the Social Security retirement, disability, spousal, or survivor benefits of people who work in jobs in which they pay Social Security taxes and jobs in which they do not pay Social Security taxes—for example, educators who take part-time or summer jobs to make ends meet. The GPO reduces the Social Security spousal or survivor benefits of people who receive a government pension but did not pay Social Security taxes themselves. Two-thirds of the pension amount is deducted from the Social Security benefit, and if two-thirds of your government pension is more than your spousal Social Security benefit, you could lose your entire Social Security benefit.

There are currently two bills before the U.S. Congress that would entirely repeal GPO and WEP.

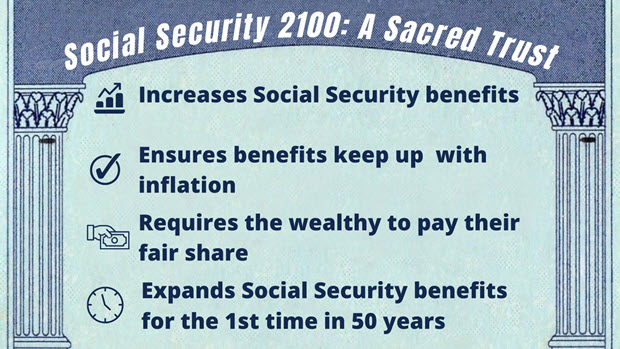

- The Social Security 2100 Act introduced by Sen. Richard Blumenthal (D-CT) and Rep. John Larson (D-CT), would fully repeal both the GPO and WEP, expand and strengthen benefits, and ensure that wealthier Americans pay their fair share.

- The bipartisan Social Security Fairness Act introduced by Sens. Sherrod Brown (D-OH) and Susan Collins (R-ME) and Reps. Abigail Spanberger (D-VA) and Rodney Davis (R-IL), would fully repeal both the GPO and WEP.

Connecticut’s Congressional delegation has long supported the repeal of GPO and WEP. Please thank them for their support and urge them to keep up their work to expand Social Security’s modest benefits so that educators are not unfairly penalized.

Contact your U.S. Senators and Representative using the links below.