The first phase of Connecticut’s new model math curriculum for grades 6 to 8 and financial literacy curriculum for grades 6 to 12 was released recently. Developed by a team that includes classroom teachers, the curricula are designed to be flexible for teachers; rigorous and consistent; as well as diverse, equitable, and inclusive.

“As a parent, an educator, and a math teacher specifically, I cannot overemphasize the value of a relevant mathematics curriculum that includes a strong financial literacy component,” said CEA President Kate Dias. “What’s especially exciting about these new resources is that they were developed by teachers for teachers, with students at the center of it all.”

At a press conference at Berlin High School announcing the release of the model curricula, State Department of Education Commissioner Charlene Russell-Tucker noted that because the curricula are culturally relevant, they will facilitate deeper connections between teachers, students, and concepts being taught.

“Connecticut has a beautifully diverse student body of more than a half-million students,” Russell-Tucker said. “The monumental rollout of this model curriculum will strengthen our schools and improve outcomes for students. Whether in an urban, rural, or suburban district, all educators will have free access to high-quality curricula and instructional resources.”

“We have the best teachers,” Governor Ned Lamont noted, “and we are happy to support and supplement the work they do.”

Teachers at the table

Thompson Middle School math teacher Patricia Chenail, who has created curriculum in her heavily underresourced, rural district, was one of several educators who helped craft the new curricula.

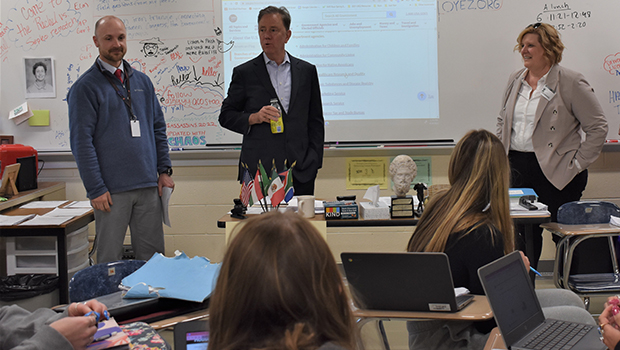

CEA President Kate Dias, center, talks with Ansonia business teacher Rubin Little and Thompson math teacher Patricia Chenail who helped develop the new curricula.

“It’s very difficult for small districts like mine to have the funds, time, and manpower to develop a curriculum as powerful as this one,” said Chenail. “I’m very honored to be asked to be part of this project, and I’m excited about the built-in resources and rigorous learning activities we’ve developed that will help students and save teachers time. Instead of having to write their own curriculum and put together all the lessons and resources for it, teachers are freed up to get right to the learning experiences. While many skills are taught in isolation, this curriculum allows for collaboration. It provides opportunities for cross-curricular learning, which will allow students to transfer their learning from one subject area to another. It also provides an opportunity for teachers to collaborate in that learning. It includes multiple modalities, hands-on learning, visuals, differentiation among students, the incorporation of real-world scenarios, and the rigor that’s associated with true problem-solvers.”

Ansonia Middle School business teacher Rubin Little, who came to teaching through the ARC program after a 30-year career as a financial advisor, was also part of the group that developed the new curricula.

Recalling one of his first lessons in financial literacy as a child, he described growing up in a New Haven housing project where a “goody truck” came through on weekends. One Saturday, when the price of bubblegum went up from two cents to a nickel, Little realized that the quarter his parents gave him wouldn’t go as far. His point? Although it’s often thought that personal finance cannot be taught until the upper grades, those lessons can and do come early.

Entering teaching as a second career, he said, also made it clear that the notion of teachers being “disconnected from the real world” is a myth.

“I beg to differ, coming from the real world to the classroom, and I can tell you that teachers are working very hard for their students to make sure they’re successful.”

Connecticut’s new model curricula in math and financial literacy are publicly available through the state’s digital library, GoOpenCT, and virtual training will be made available to all teachers.